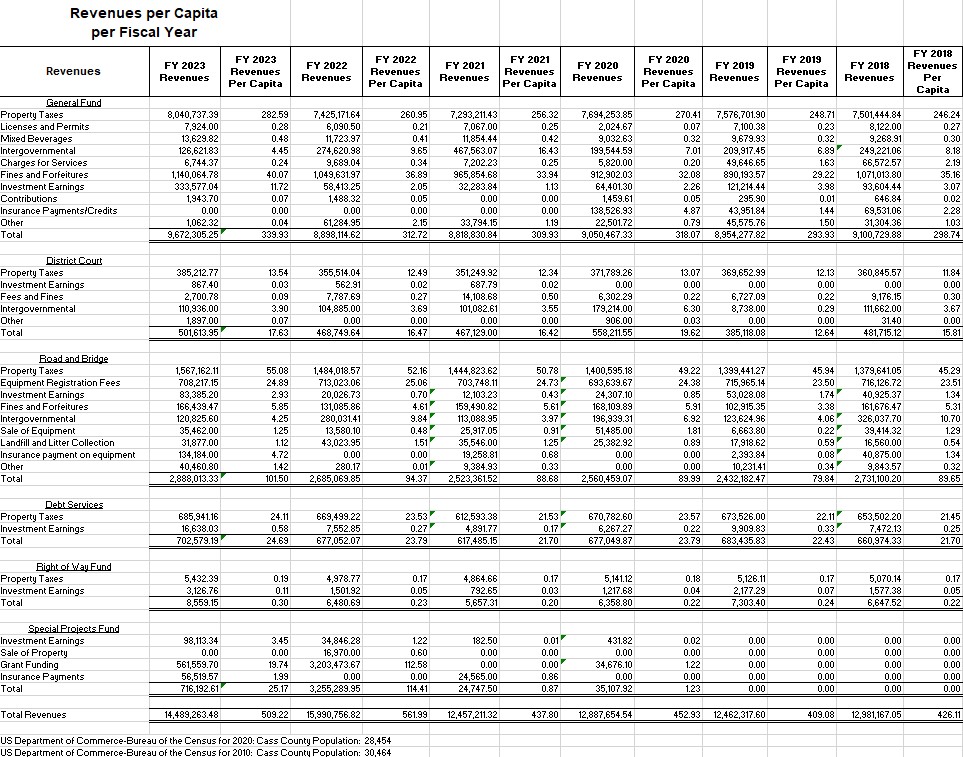

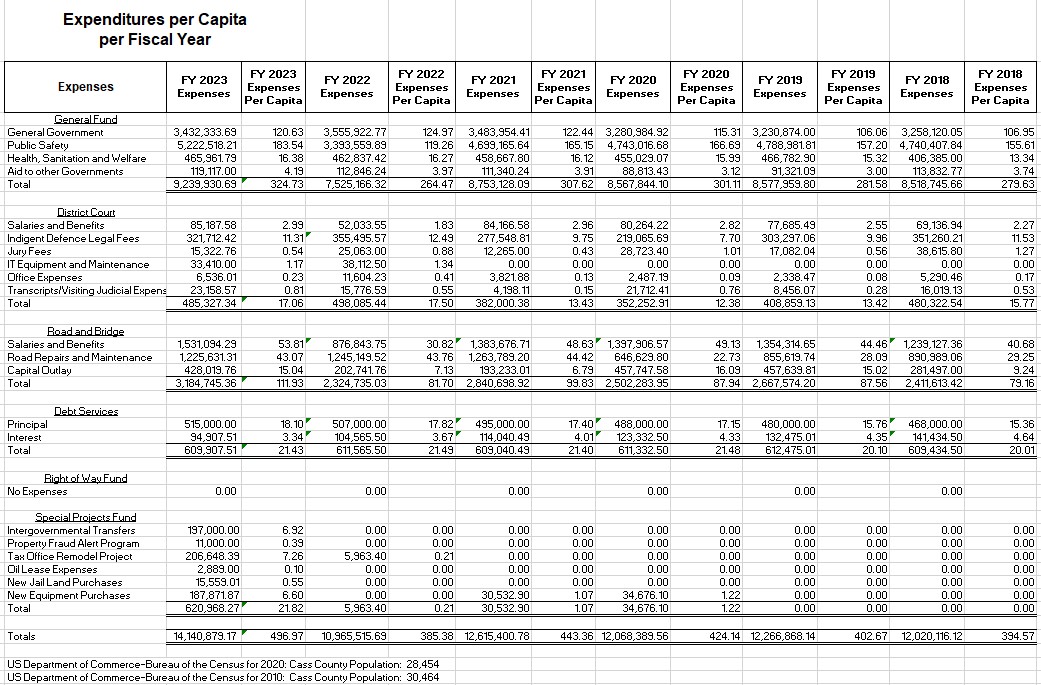

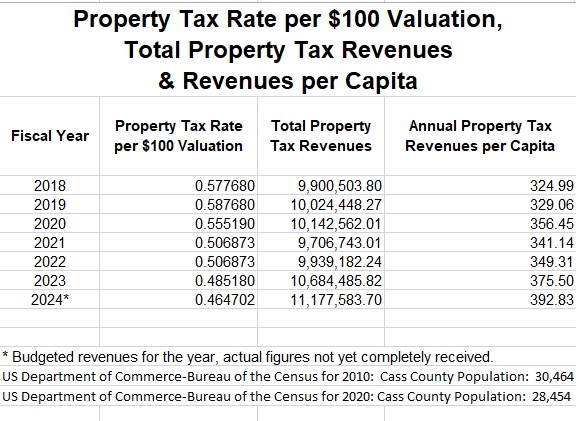

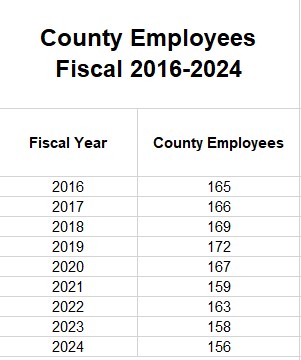

As an introduction to Cass County's revenues and expenditures, the tables below summarize the County’s financial position.

Cass County DOES NOT collect any revenues from Sales Taxes. Revenues received by Cass County come via Property Taxes, Grants and various fees for services provided or fines for Law Enforcement citations.

These figures include per capita calculations based on U.S. Department of Commerce-Bureau of the Census for population data for 2010 and 2020 for reports prior to and after 2020, respectively.

Terminology / Description of Summary Information

Revenues - the income that the County has received from its normal activities.

Expenditures - an expenditure is a payment or disbursement. The expenditure may be for the purchase of an asset, a reduction of a liability, or it could be an expense.

Property Taxes - a levy on property that the owner is required to pay. The tax is levied by the governing authority of the jurisdiction in which the property is located; it may be paid to a national government, a federated state, a county or geographical region, or a municipality. Multiple jurisdictions may tax the same property.

Per Capita - for each person; in relation to people taken individually.

Fiscal Year - a fiscal year (or financial year, or sometimes budget year) is a period used for calculating annual ("yearly") financial statements in the County. For the County of Cass, the Fiscal Year is October 1st through September 30th of the following year.